Unicommerce eSolutions IPO Details, Financials, Valuation & Peers

Get everything you need to know about the Unicommerce eSolutions IPO. Explore Unicommerce eSolutions IPO details, including IPO dates, financial statements, valuation, peer comparison, and more.

Overview

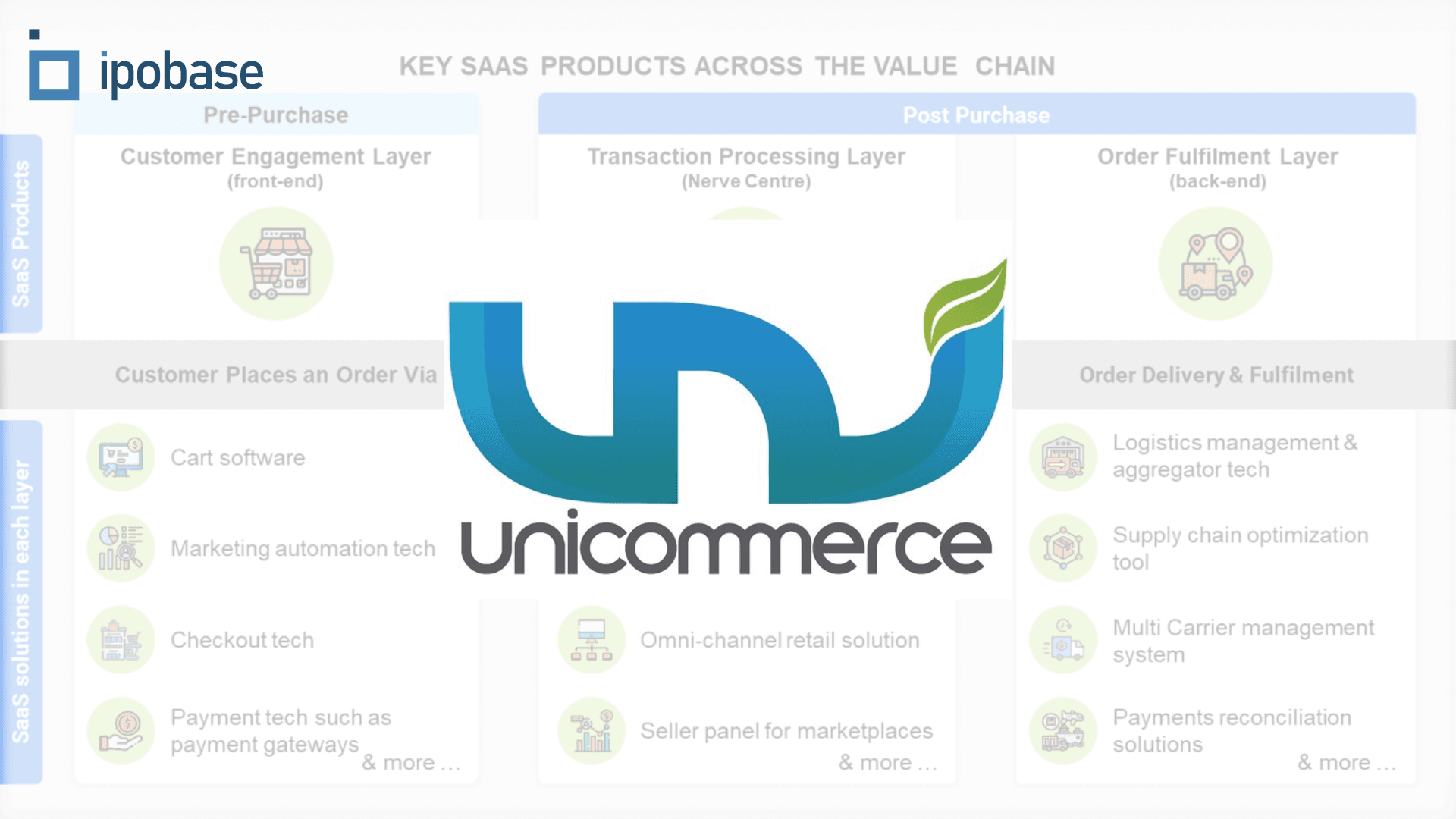

Unicommerce eSolutions Limited is an e-commerce enablement Software-as-a-Service (SaaS) platform that specializes in end-to-end management of e-commerce operations for brands, sellers, and logistics service providers. Established as a critical part of the supply chain, Unicommerce empowers enterprise clients and small to medium-sized businesses (SMBs) to efficiently handle post-purchase e-commerce operations through a comprehensive suite of SaaS products. These include warehouse and inventory management, multi-channel order management, omni-channel retail management, seller management for marketplaces, logistics tracking and courier allocation, and payment reconciliation.

Key Points:

- Comprehensive SaaS Solutions:

- Warehouse and Inventory Management System (WMS): Efficient management of inventory across different scales and locations.

- Multi-Channel Order Management System (OMS): Automates inventory syncing and order processing across various demand channels.

- Omni-Channel Retail Management System (Omni-RMS): Centralized management of online and offline sales channels, optimizing sales and inventory turnover.

- Seller Management Panel: Facilitates marketplace dropship operations with third-party sellers.

- UniShip: Provides shipment tracking and smart courier partner allocation.

- UniReco: Automates payment reconciliation for transactions across different sales channels.

- Market Position:

- Largest e-commerce enablement SaaS platform in India based on revenue for the fiscal years ending March 31, 2021, 2022, and 2023.

- The only profitable company among the top five players in this industry in India during Fiscal 2023.

- Scalable and Flexible:

- Designed to meet the dynamic needs of various retail enterprises, from SMBs to large enterprises.

- Sector and size-agnostic products that can be configured to suit specific client workflows and business needs.

- Extensive Integrations:

- Over 131 Marketplace and WebStore integrations, 101 Logistics Partner integrations, and 11 ERP, POS, and other systems integrations as of March 31, 2024.

- Enables seamless data exchange and automation across the supply chain stack.

- Client Base:

- Includes D2C brands, brand aggregators, traditionally offline brands, e-commerce retailers, marketplaces, third-party logistics providers, and SMBs.

- Serves a diverse range of sectors such as fashion, electronics, home and kitchen, FMCG, beauty and personal care, sports and fitness, nutrition, health and pharma.

Objects of the Issue

- Carry out the Offer for Sale of up to 25,608,512 Equity Shares of face value of ₹1 each by the Selling Shareholders

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 06 Aug - 08 Aug 2024 |

| IPO Price Band | ₹ 102 - 108 per share |

| Fresh Issue | NIL |

| Offer For Sale | 25,608,512 shares (₹ 276.57 crore) |

| Total IPO Size | Approx ₹ 276.57 crore |

| Face Value | ₹ 1 |

| Listing On | BSE, NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 06 Aug 2024 |

| IPO Closing Date | 08 Aug 2024 |

| Basis Of Allotment | 09 Aug 2024 |

| Refunds | 12 Aug 2024 |

| Demat Transfer | 12 Aug 2024 |

| IPO Listing Date | 13 Aug 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| Total Income | 42.18 | 61.36 | 92.97 | 109.43 |

| Total Expenses | 36.78 | 54.45 | 84.11 | 91.96 |

| Net Profit/Loss | 4.48 | 6.01 | 6.48 | 13.08 |

| NPM (*) | 11.19 | 10.18 | 7.19 | 12.63 |

| Total Assets | 45.59 | 59.03 | 81.74 | 109.11 |

| Total Liabilities | 12.33 | 17.66 | 29.85 | 40.20 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| EPS | 0.41 | 0.55 | 0.58 | 1.16 |

| ROE (%) | 14.93 | 16.11 | 13.89 | 17.36 |

| ROCE (%) | 9.71 | 11.09 | 11.46 | 25.93 |

| D/E Ratio | NA | NA | NA | NA |

| Current Ratio | 4.51 | 1.74 | 2.97 | 3.01 |

| EBITDA MARGIN (%) | 8.78 | 8.54 | 7.25 | 13.92 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

No listed peers available for comparison.

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 138.75 |

| Non-Institutional Investor (NII/HNI) | 252.46 |

| Retail Individual Investor (RII) | 130.99 |

| Total | 168.35 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

MUFG Intime India Private Limited (Formerly known as Link Intime India Private Limited)

Phone: + 91 810 811 4949

Email: ipo.helpdesk@linkintime.co.in

Website: https://linkintime.co.in/

Company Promoters

- ACEVECTOR LIMITED (FORMERLY KNOWN AS SNAPDEAL LIMITED)

- STARFISH I PTE. LTD.

- KUNAL BAHL

- ROHIT KUMAR BANSAL

Lead Managers

- IIFL Securities Limited

- CLSA India Private Limited

Company Address

Unicommerce eSolutions Limited

Mezzanine Floor, A-83, Okhla Industrial Area, Ph-II, New Delhi 110 020, India

Phone: +91 9311749240

Email: complianceofficer@unicommerce.com

Website: www.unicommerce.com

FAQs

- What is the issue size of the Unicommerce eSolutions IPO?The Unicommerce eSolutions IPO has an issue size of Approx ₹ 276.57 crore. This includes a fresh issue of NIL and an offer for sale (OFS) of 25,608,512 shares (₹ 276.57 crore).

- What is the price band of the Unicommerce eSolutions IPO?The price band for the Unicommerce eSolutions IPO is ₹ 102 - 108 per share.

- What are the bidding dates for the Unicommerce eSolutions IPO?The Unicommerce eSolutions IPO will open for bidding on 06 Aug 2024 and close on 08 Aug 2024.

- What is the allotment date for the Unicommerce eSolutions IPO?The allotment date for the Unicommerce eSolutions IPO is 09 Aug 2024.

- What is the listing date for the Unicommerce eSolutions IPO?The listing date for the Unicommerce eSolutions IPO is 13 Aug 2024.

- What is the Unicommerce eSolutions IPO grey market premium?The grey market premium (GMP) for the Unicommerce eSolutions IPO is currently at ₹69, with an expected listing gain of approximately 63.89%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.