Tunwal E-Motors SME IPO Details, Financials, Valuation & Peers

Get everything you need to know about the Tunwal E-Motors IPO. Explore Tunwal E-Motors IPO details, including IPO dates, financial statements, valuation, peer comparison, and more.

Overview

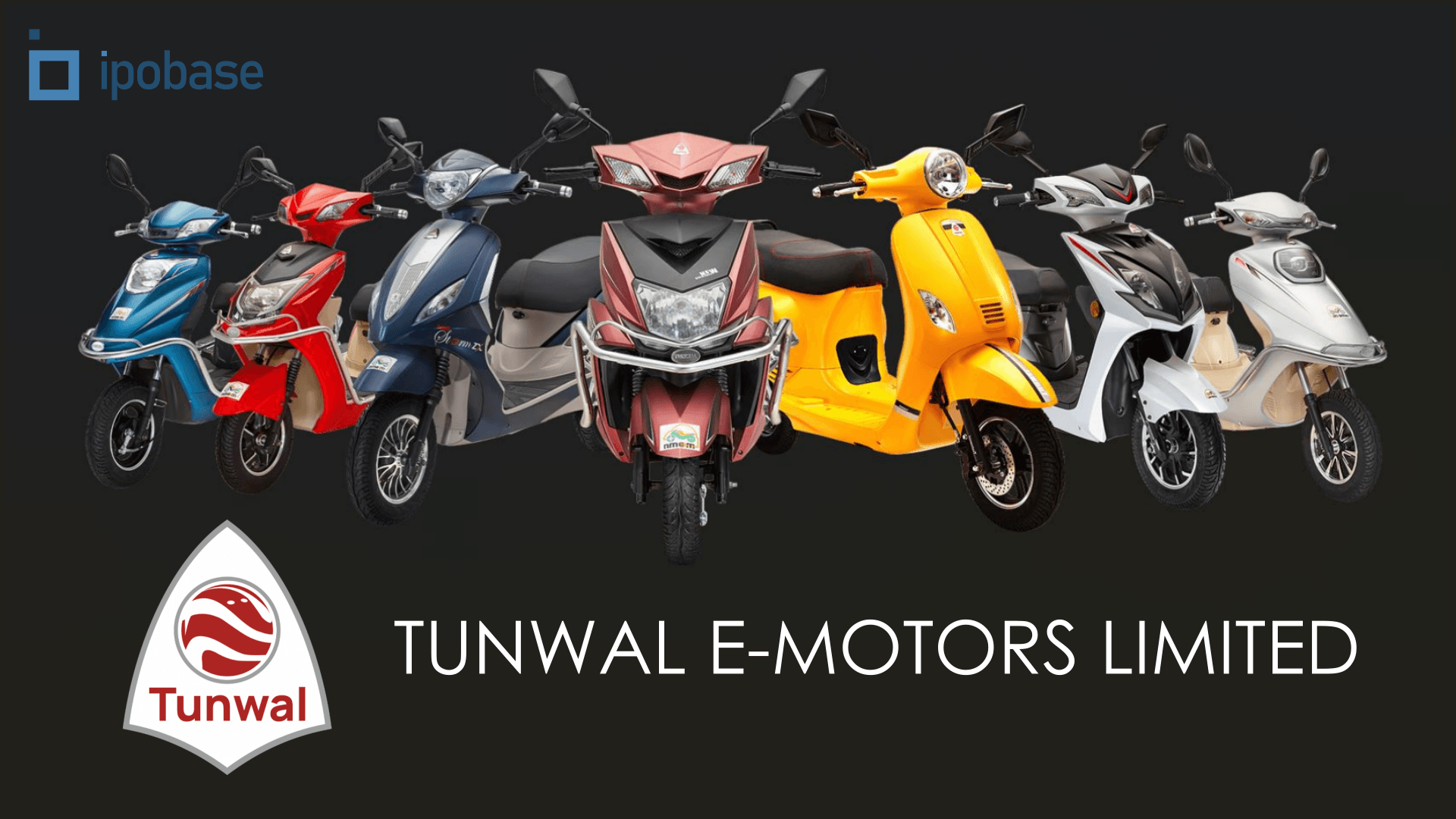

Tunwal E-Motors Limited, established on December 21, 2018, is a prominent player in India's electric vehicle (EV) two-wheeler sector. The company specializes in designing, developing, manufacturing, and distributing high-quality electric two-wheelers. Tunwal E-Motors leverages efficient manufacturing and assembly processes at its state-of-the-art production facility located in Palsana, Rajasthan. With a focus on delivering user-friendly, technologically advanced, and affordable electric scooters, the company aims to contribute to a cleaner and more sustainable future.

Key Points:

- Business Focus:

- Specializes in electric two-wheeler vehicles.

- Committed to innovation in EV manufacturing.

- Offers more than 23 models, including 7 variants of two-wheelers.

- Market Presence:

- Established a dealer base of over 225 across India.

- Aims to enhance market penetration through a robust dealer network, continuous innovation, and providing comprehensive after-sales service and support.

- Revenue Model:

- Primary revenue from sales of electric two-wheelers through an established distributor/dealer network.

- Dealer network facilitates product sales and maintenance services.

- Revenue also generated from spare parts sales.

Objects of the Issue

- Funding of working capital requirements of the Company.

- Research & Development

- Pursuing Inorganic Growth

- General Corporate Expenses

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 15 Jul - 18 Jul 2024 |

| IPO Price Band | ₹ 59 per share |

| Fresh Issue | 1,38,50,000 shares (₹ 81.72 crore) |

| Offer For Sale | 57,50,000 shares (₹ 33.93 crore) |

| Total IPO Size | ₹ 115.64 crore |

| Face Value | ₹ 2 |

| Listing On | NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 15 Jul 2024 |

| IPO Closing Date | 18 Jul 2024 |

| Basis Of Allotment | 19 Jul 2024 |

| Refunds | 22 Jul 2024 |

| Demat Transfer | 22 Jul 2024 |

| IPO Listing Date | 23 Jul 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| Total Income | 1.28 | 75.66 | 76.56 | 105.54 |

| Total Expenses | 1.18 | 72.42 | 71.63 | 89.77 |

| Net Profit/Loss | 0.07 | 2.34 | 3.72 | 11.81 |

| NPM (*) | 5.61 | 3.10 | 4.87 | 11.29 |

| Total Assets | 5.78 | 50.37 | 56.94 | 75.83 |

| Total Liabilities | 5.15 | 46.13 | 48.73 | 55.30 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2022 | 31st March 2024 |

|---|---|---|---|---|

| EPS | 0.80 | 1.21 | 1.81 | 2.85 |

| ROE (%) | 11.50 | 55.12 | 45.32 | 57.53 |

| ROCE (%) | 12.48 | 27.13 | 31.97 | 59.38 |

| D/E Ratio | 5.34 | 3.20 | 2.30 | 1.00 |

| Current Ratio | 0.69 | 1.14 | 1.18 | 1.40 |

| EBITDA MARGIN (%) | 33.24 | 5.74 | 8.64 | 17.05 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Tunwal EMotors Ltd | 104.60 | 20.70 | 2.85 | 57.53 | 4.95 |

| Wardwizard Innovations & Mobililty Limited | 321.42 | 117.96 | 0.52 | 13.27 | 3.88 |

| TVS Motors | 39,144.74 | 66.33 | 35.50 | 23.68 | 158.10 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 0 |

| Non-Institutional Investor (NII/HNI) | 7.61 |

| Retail Individual Investor (RII) | 16.64 |

| Total | 12.31 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

Skyline Financial Services Private Limited

Phone: 011-40450193-197

Email: ipo@skylinerta.com

Website: www.skylinerta.com

Company Promoters

- JHUMARMAL PANNARAM TUNWAL

Lead Managers

- Horizon Management Private Limited

Company Address

Tunwal E-Motors LIMITED

Rama Icon Commercial Building, Office No 501, S.No 24/2, C.T.S No. 2164, Plot No. 31/11 Sadashiv Peth, Pune, 411030 Maharashtra India.

Phone: +91-20-24336001

Email: cs@tunwal.com

Website: www.tunwal.com

FAQs

- What is the issue size of the Tunwal E-Motors SME IPO?The Tunwal E-Motors SME IPO has an issue size of ₹ 115.64 crore. This includes a fresh issue of 1,38,50,000 shares (₹ 81.72 crore) and an offer for sale (OFS) of 57,50,000 shares (₹ 33.93 crore).

- What is the price band of the Tunwal E-Motors IPO?The price band for the Tunwal E-Motors IPO is ₹ 59 per share.

- What are the bidding dates for the Tunwal E-Motors IPO?The Tunwal E-Motors IPO will open for bidding on 15 Jul 2024 and close on 18 Jul 2024.

- What is the allotment date for the Tunwal E-Motors IPO?The allotment date for the Tunwal E-Motors IPO is 19 Jul 2024.

- What is the listing date for the Tunwal E-Motors IPO?The listing date for the Tunwal E-Motors IPO is 23 Jul 2024.

- What is the Tunwal E-Motors IPO grey market premium?The grey market premium (GMP) for the Tunwal E-Motors IPO is currently at ₹5, with an expected listing gain of approximately 8.47%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.