Refractory Shapes IPO Details, Financials, Valuation & Peers

Get everything you need to know about the Refractory Shapes IPO. Explore Refractory Shapes IPO details, including IPO dates, financial statements, valuation, peer comparison, and more.

Overview

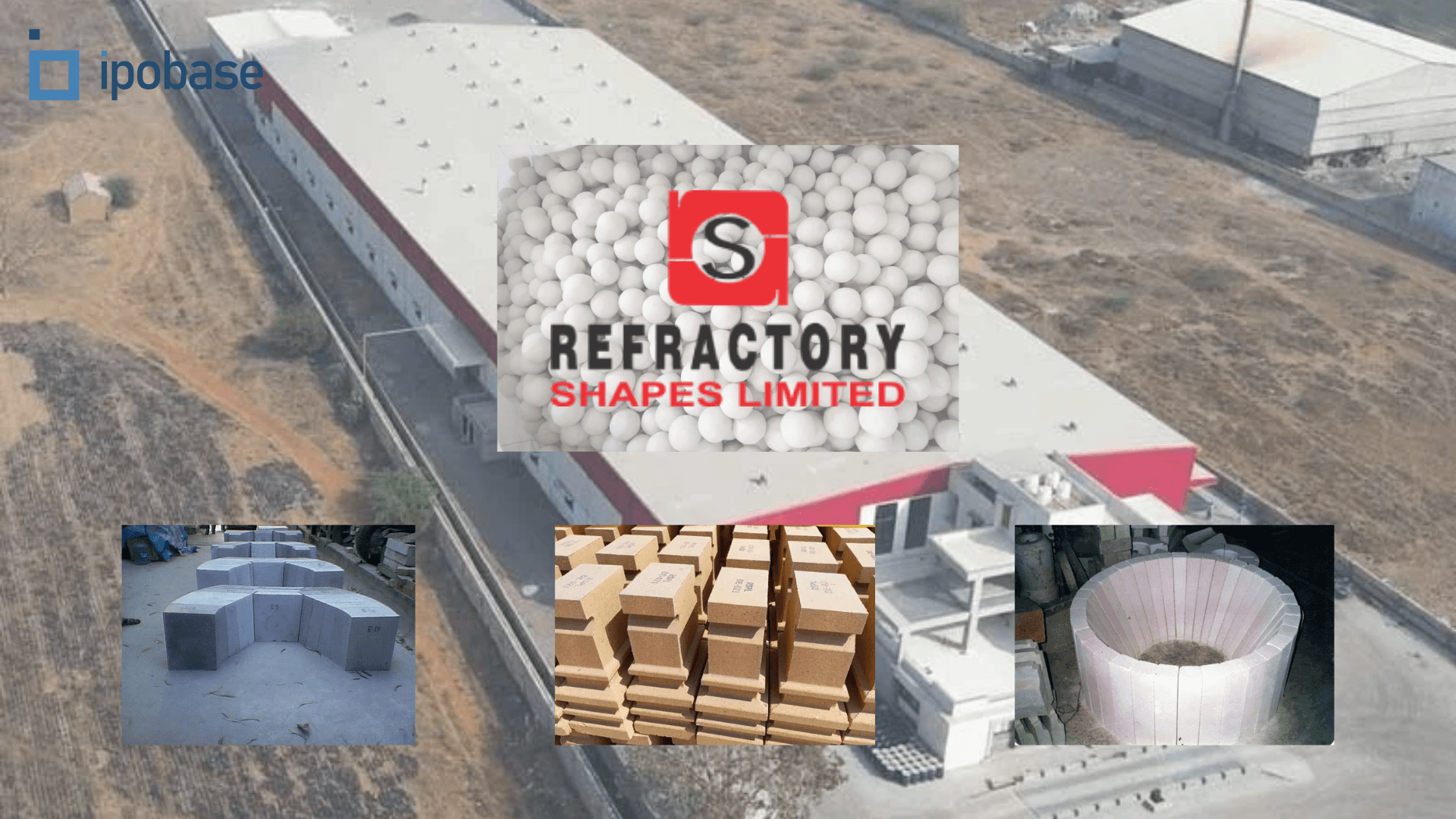

Refractory Shapes Limited specializes in manufacturing a wide range of refractory products such as bricks, castables, high alumina catalysts, and ceramic balls, catering to various industries including steel, refineries, fertilizers, petrochemicals, glass, and cement. Established in 1973, the company has a rich history of delivering tailored refractory solutions to meet the harsh operational demands of its clients. Led by experienced promoters, Refractory Shapes has expanded its product portfolio and operations, becoming a key player in the industry.

Key Points:

- Product Range: Refractory Shapes manufactures diverse refractory products including bricks, castables, pre-cast blocks, burner blocks, and specialized refractory shapes designed to withstand extreme conditions in various industries.

- Industry Applications: The company's refractory solutions find applications in steel production, refineries, fertilizers, petrochemicals, glass manufacturing, and cement production, contributing to enhanced operational efficiency and prolonged equipment lifespan.

- Trading Activities: In addition to manufacturing, the company engages in trading activities, procuring and supplying raw materials such as metallic anchors and insulation bricks to clients for installing refractory castables. This diversification strengthens its position in the market and ensures comprehensive customer support.

Objects of the Issue

- Funding of Capital expenditure towards civil construction required for Expansion of existing manufacturing unit at the existing location situated at Wankaner, Gujarat

- Funding of Capital expenditure towards purchase of Plant and Machineries for Expanding existing manufacturing unit at the existing location situated at Wankaner, Gujarat

- Repayment/prepayment of all or certain of the borrowings availed of by the Company

- Purchase of Commercial Vehicle

- General Corporate Purpose

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 06 May - 09 May 2024 |

| IPO Price Band | ₹ 27 - 31 per share |

| Fresh Issue | Upto 60,00,000 Shares |

| Offer For Sale | NIL |

| Total IPO Size | ₹ 18.60 crore |

| Face Value | ₹ 10 |

| Listing On | NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 06 May 2024 |

| IPO Closing Date | 09 May 2024 |

| Basis Of Allotment | 10 May 2024 |

| Refunds | 13 May 2024 |

| Demat Transfer | 13 May 2024 |

| IPO Listing Date | 14 May 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | Dec 2023 |

|---|---|---|---|---|

| Total Income | 21.80 | 26.22 | 38.72 | 30.0 |

| Total Expenses | 19.68 | 22.84 | 36.23 | 25.98 |

| Net Profit/Loss | 1.56 | 2.87 | 1.92 | 3.08 |

| NPM (*) | 7.49 | 11.26 | 5.05 | 10.47 |

| Total Assets | 27.24 | 36.85 | 50.04 | 52.90 |

| Total Liabilities | 15.34 | 22.08 | 33.35 | 33.13 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | Dec 2023 |

|---|---|---|---|---|

| EPS | 0.99 | 1.82 | 1.21 | 0.97 |

| ROE (%) | 14.07 | 21.53 | 12.19 | 15.58 |

| ROCE (%) | 9.54 | 11.38 | 8.04 | 9.79 |

| D/E Ratio | 1.04 | 1.06 | 1.23 | 1.18 |

| Current Ratio | 3.08 | 1.53 | 1.02 | 1.25 |

| EBITDA MARGIN (%) | 11.23 | 14.17 | 10.21 | 20.68 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Refractory Shapes Limited | 37.97 | 25.62 | 1.21 | 11.49 | 10.56 |

| S P Refractories Limited | 27.24 | 17.45 | 6.56 | 7.13 | 49.97 |

| IFGL Refractories Limited | 833.37 | 31.91 | 16.97 | 10.12 | 172.67 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 90.59 |

| Non-Institutional Investor (NII/HNI) | 464.43 |

| Retail Individual Investor (RII) | 259.56 |

| Total | 255.08 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

Bigshare Services Private Limited

Phone: +91 22-62638200

Email: ipo@bigshareonline.com

Website: www.bigshareonline.com

Company Promoters

- MR. DAYSHANKAR KRISHNA SHETTY

- MS. PRATIBHA DAYASHANKAR SHETTY

- MS. PRAJNA SHRAVAN SHETTY

- MR. SURAJ SADANAND SHETTY

Lead Managers

- SHRENI SHARES LIMITED

Company Address

Refractory Shapes Limited

B 201, Rustomjee Central Park Chakala, Andheri-Kurla Road, Andheri (East), Mumbai-400069, Maharashtra, India

Phone: + 91 9819995930

Email: investors@refshape.com

Website: www.refshape.com

FAQs

- What is the issue size of the Refractory Shapes SME IPO?The Refractory Shapes SME IPO has an issue size of ₹ 18.60 crore. This includes a fresh issue of Upto 60,00,000 Shares and an offer for sale (OFS) of NIL.

- What is the price band of the Refractory Shapes IPO?The price band for the Refractory Shapes IPO is ₹ 27 - 31 per share.

- What are the bidding dates for the Refractory Shapes IPO?The Refractory Shapes IPO will open for bidding on 06 May 2024 and close on 09 May 2024.

- What is the allotment date for the Refractory Shapes IPO?The allotment date for the Refractory Shapes IPO is 10 May 2024.

- What is the listing date for the Refractory Shapes IPO?The listing date for the Refractory Shapes IPO is 14 May 2024.

- What is the Refractory Shapes IPO grey market premium?The grey market premium (GMP) for the Refractory Shapes IPO is currently at ₹25, with an expected listing gain of approximately 80.65%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.