Mamata Machinery IPO Details, Financials, Valuation & Peers

Explore Mamata Machinery IPO details, including IPO dates, financial statements, valuation, peer comparison and more.

Overview

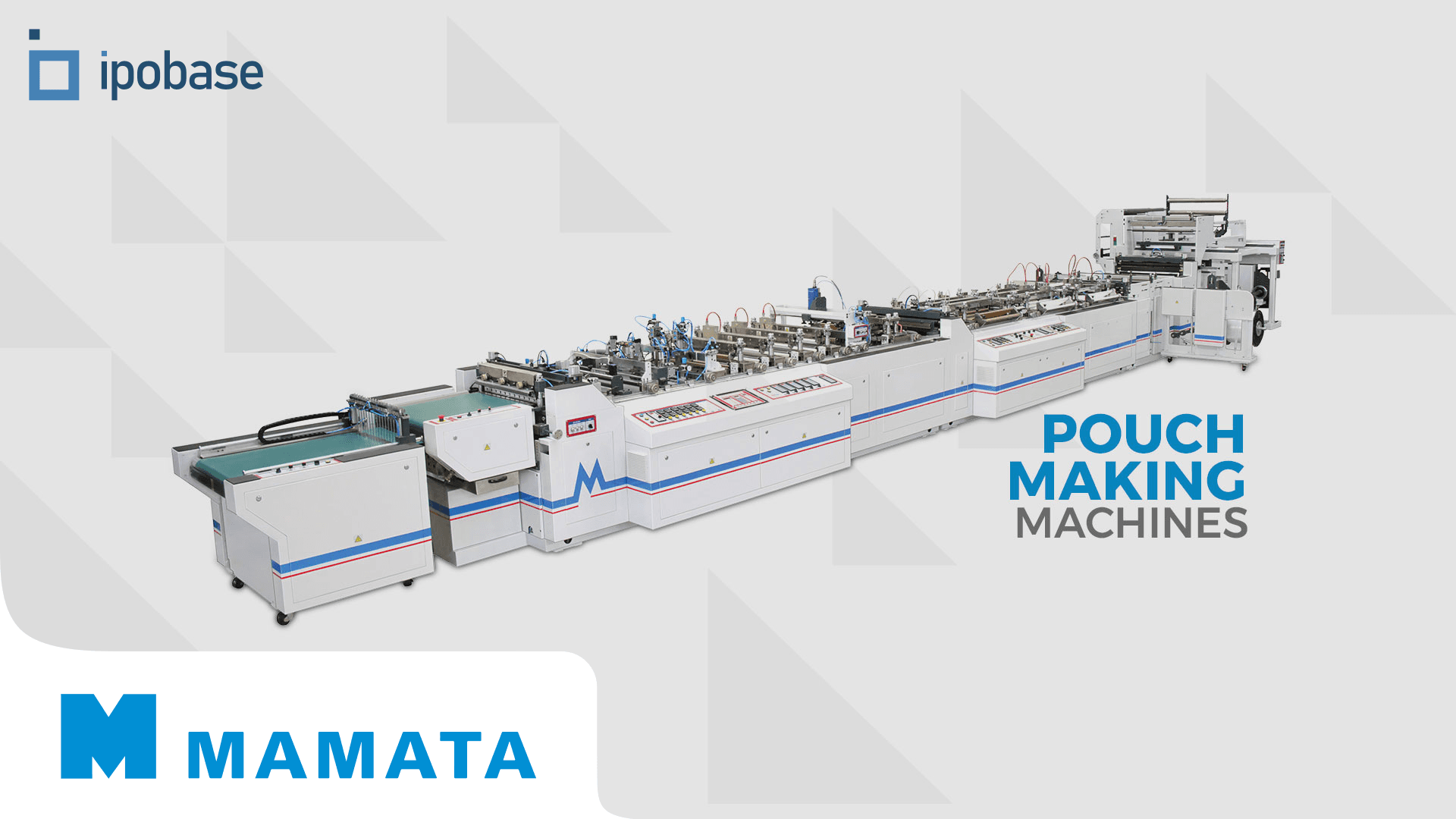

Mamata Machinery Limited is a manufacturer and exporter of advanced plastic bag and pouch-making machines, packaging machinery, and extrusion equipment. The company provides end-to-end solutions for the flexible packaging industry, serving diverse sectors like FMCG, food, beverages, e-commerce, and garments. With over 4,500 machines installed across 75 countries, Mamata has established itself as a global leader, driven by innovation, quality, and customer-focused solutions. Founded in 1989, the company operates two state-of-the-art manufacturing facilities in Gujarat, India, and Florida, USA, along with sales and service offices worldwide. Mamata leverages cutting-edge technologies and holds multiple patents for its innovative machinery. It offers a comprehensive range of products, including bag and pouch-making machines, packaging machines, and co-extrusion blown film plants.

Key Points:

- Product Range:

- Bag and Pouch Making Machines: Includes side and bottom seal bag makers, universal machines, servo wicketers, and stand-up zipper pouch makers.

- Packaging Machinery: Horizontal and vertical form-fill-seal (HFFS & VFFS) machines, multi-lane sachet packaging machines, and pick-fill-seal machines.

- Co-Extrusion Blown Film Machines: Multilayer film plants ranging from mono-layer to seven-layer configurations.

- Global Presence:

- Supplied machinery to clients in over 75 countries.

- International offices in Bradenton, Florida, and Montgomery, Illinois, USA.

- Strong global sales network supported by agents in multiple countries across Europe, South Africa, and Asia.

- Clientele:

Trusted by renowned brands, including Balaji Wafers, Chitale Foods, Hershey India, Emirates National Factory for Plastic, and many more. - Innovation and Patents:

- Holds patents for high-speed bag stacking, flat bottom pouch production, multi-purpose sealing modules, and cross-sealing devices.

- Active focus on R&D with a team of 87 engineers and application experts.

Objects of the Issue

- To carry out the Offer for Sale of up to 7,382,340 Equity Shares by the Selling Shareholders

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 19 Dec - 23 Dec 2024 |

| IPO Price Band | ₹230 - ₹243 per share |

| Fresh Issue | NIL |

| Offer For Sale | 7,382,340 Shares |

| Total IPO Size | ₹179.39 crore |

| Face Value | ₹10 |

| Listing On | BSE, NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 19 Dec 2024 |

| IPO Closing Date | 23 Dec 2024 |

| Basis Of Allotment | 24 Dec 2024 |

| Refunds | 26 Dec 2024 |

| Demat Transfer | 26 Dec 2024 |

| IPO Listing Date | 27 Dec 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2022 | 31st March 2023 | 31st March 2024 | Jun 2024 |

|---|---|---|---|---|

| Total Income | 196.57 | 210.13 | 241.31 | 29.19 |

| Total Expenses | 167.03 | 181.61 | 194.38 | 28.87 |

| Net Profit/Loss | 21.70 | 22.51 | 36.13 | 0.22 |

| NPM (*) | 11.29 | 11.20 | 15.27 | 0.79 |

| Total Assets | 216.33 | 228.47 | 237.49 | 240.85 |

| Total Liabilities | 112.27 | 100.59 | 105.11 | 107.53 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2022 | 31st March 2023 | 31st March 2024 | Jun 2024 |

|---|---|---|---|---|

| EPS | 8.11 | 8.41 | 14.65 | 0.09 |

| ROE (%) | 23.12 | 19.41 | 27.76 | 0.16 |

| ROCE (%) | 25.73 | 15.71 | 31.29 | -0.78 |

| D/E Ratio | 0.20 | 0.15 | 0.09 | 0.03 |

| Current Ratio | 0.99 | 1.03 | 1.21 | 1.28 |

| EBITDA MARGIN (%) | 15.57 | 11.82 | 19.94 | -1.14 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Mamata Machinery Limited | 236.61 | 16.59 | 14.65 | 27.39 | 53.59 |

| Rajoo Engineers Limited | 197.35 | 57.16 | 3.41 | 16.59 | 20.59 |

| Windsor Machines Limited | 353.97 | Negative | -1.19 | -2.89 | 41.07 |

| Kabra Extrusion Technik Limited | 607.77 | 30.64 | 9.67 | 7.48 | 134.52 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

IPO Reservation

| Investor Type | Shares Offered |

|---|---|

| Qualified Institutional Buyer (QIB) | Not less than 50% |

| Non-Institutional Investor (NII/HNI) | Not less than 15% |

| Retail Individual Investor (RII) | Not less than 35% |

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 235.88 |

| Non-Institutional Investor (NII/HNI) | 274.38 |

| Retail Individual Investor (RII) | 138.08 |

| Total | 194.95 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

MUFG Intime India Private Limited (Formerly known as Link Intime India Private Limited)

Phone: + 91 810 811 4949

Email: ipo.helpdesk@linkintime.co.in

Website: https://linkintime.co.in/

Company Promoters

- MAHENDRA PATEL

- CHANDRAKANT PATEL

- NAYANA PATEL

- BHAGVATI PATEL

- MAMATA GROUP CORPORATE SERVICES LLP

- MAMATA MANAGEMENT SERVICES LLP

Lead Managers

- Beeline Capital Advisors Private Limited

Company Address

Mamata Machinery Limited

Survey No. 423/P, Sarkhej-Bavla Road, N.H No. 8A, Moraiya, Sanand, Ahmedabad, Gujarat – 382 213, India

Phone: 02717–630 800/801

Email: investor@mamata.com

Website: www.mamata.com

FAQs

- What is the issue size of the Mamata Machinery IPO?The Mamata Machinery IPO has an issue size of ₹179.39 crore. This includes a fresh issue of NIL and an offer for sale (OFS) of 7,382,340 Shares.

- What is the price band of the Mamata Machinery IPO?The price band for the Mamata Machinery IPO is ₹230 - ₹243 per share.

- What are the bidding dates for the Mamata Machinery IPO?The Mamata Machinery IPO will open for bidding on 19 Dec 2024 and close on 23 Dec 2024.

- What is the allotment date for the Mamata Machinery IPO?The allotment date for the Mamata Machinery IPO is 24 Dec 2024.

- What is the minimum lot size and investment required for the Mamata Machinery IPO?The minimum lot size for the Mamata Machinery IPO is 61 shares and the minimum investment required is ₹14,823.

- What is the listing date for the Mamata Machinery IPO?The listing date for the Mamata Machinery IPO is 27 Dec 2024.

- What is the Mamata Machinery IPO grey market premium?The grey market premium (GMP) for the Mamata Machinery IPO is currently at ₹260, with an expected listing gain of approximately 107%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.