Kross IPO Details, Financials, Valuation & Peers

Get everything you need to know about the Kross IPO. Explore Kross IPO details, including IPO dates, financial statements, valuation, peer comparison, and more.

Overview

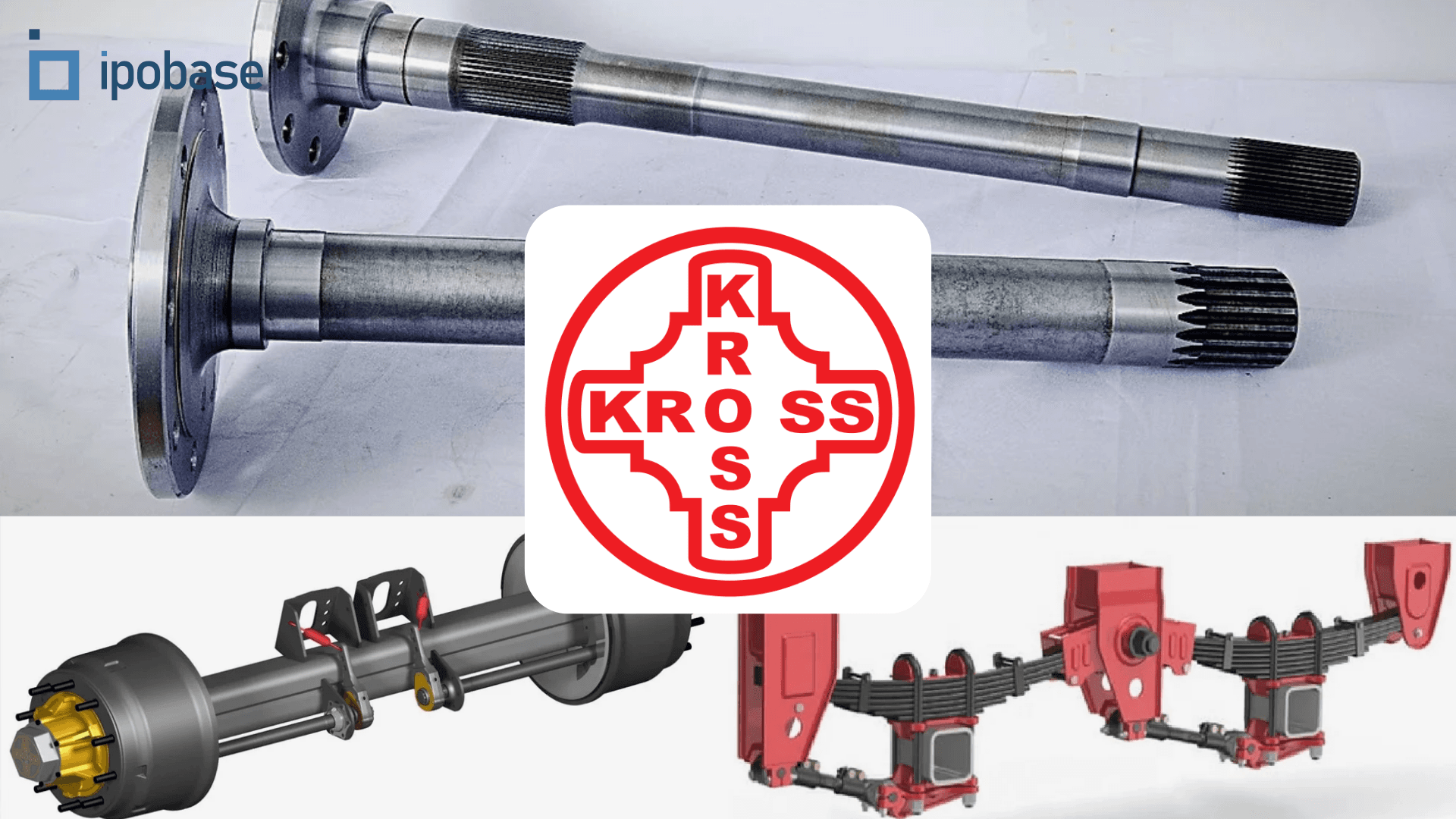

Kross Limited specializes in manufacturing and supplying trailer axle and suspension assemblies, along with a variety of high-performance, safety-critical parts that are forged and precision-machined. These products cater primarily to the medium and heavy commercial vehicles (M&HCV) and farm equipment segments. Recognized as a prominent manufacturer in India, Kross Limited has rapidly grown since commencing the production and sale of trailer axle and suspension assemblies in 2019. With over three decades of industry experience, the company has established itself as a specialist in producing safety-critical components, offering a diversified portfolio to a broad client base that includes large original equipment manufacturers (OEMs), tier-one suppliers, domestic dealers, and fabricators. Kross Limited operates out of five manufacturing facilities in Jamshedpur, Jharkhand, which are equipped with advanced machinery and processes.

Key Points:

- Product Portfolio:

- Specializes in manufacturing trailer axle and suspension assemblies.

- Produces a wide range of forged and precision-machined safety-critical parts for M&HCV and farm equipment, including axle shafts, anti-roll bars, suspension linkages, and PTO shafts.

- Manufacturing Capabilities:

- Operates five manufacturing facilities in Jamshedpur, equipped with forging presses, high-pressure mould lines, precision machining equipment, and heat treatment furnaces.

- Backward integration with in-house design, engineering, forging, casting, and machining capabilities.

- Forward integration with a network of sales and service locations across India.

- Client Base:

- Supplies to a diversified client base, including large OEMs, tier-one suppliers, domestic dealers, and fabricators.

- Long-term relationships with leading OEMs such as Ashok Leyland Limited and Tata International DLT Private Limited.

- Recent expansion into global markets, including exports to Leax Falun AB in Sweden.

- Growth and Expansion:

- Significant growth since the commencement of trailer axle and suspension assembly production in 2019.

- Ongoing capacity expansion to introduce new product lines and enhance existing offerings.

Objects of the Issue

- Funding of capital expenditure requirements of the Company towards purchase of machinery and equipment

- Repayment or prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by the Company, from banks and financial institutions

- Funding working capital requirements of the Company

- General corporate purposes.

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 09 Sep - 11 Sep 2024 |

| IPO Price Band | ₹228 - ₹240 per share |

| Fresh Issue | ₹250 crore |

| Offer For Sale | ₹250 crore |

| Total IPO Size | ₹500 crore |

| Face Value | ₹5 |

| Listing On | BSE, NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 09 Sep 2024 |

| IPO Closing Date | 11 Sep 2024 |

| Basis Of Allotment | 12 Sep 2024 |

| Refunds | 13 Sep 2024 |

| Demat Transfer | 13 Sep 2024 |

| IPO Listing Date | 16 Sep 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| Total Income | 184.21 | 297.88 | 489.36 | 621.46 |

| Total Expenses | 178.37 | 281.57 | 447.65 | 560.17 |

| Net Profit/Loss | 4.77 | 12.17 | 30.93 | 44.88 |

| NPM (*) | 2.59 | 4.09 | 6.32 | 7.22 |

| Total Assets | 174.07 | 197.82 | 250.57 | 352.00 |

| Total Liabilities | 114.16 | 125.42 | 148.47 | 205.20 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| EPS | 0.88 | 2.25 | 5.72 | 8.30 |

| ROE (%) | 7.96 | 16.81 | 30.29 | 30.57 |

| ROCE (%) | 10.03 | 14.97 | 27.51 | 28.15 |

| D/E Ratio | 1.39 | 1.19 | 0.86 | 0.80 |

| Current Ratio | 1.28 | 1.23 | 1.36 | 1.37 |

| EBITDA MARGIN (%) | 10.43 | 9.93 | 11.77 | 13.02 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Kross Limited | 620.25 | 28.92 | 8.30 | 30.57 | 27.14 |

| Ramkrishna Forgings Limited | 3,954.88 | 46.55 | 20.09 | 12.72 | 148.48 |

| Jamna Auto Industries Limited | 2,426.77 | 24.30 | 5.14 | 22.74 | 22.64 |

| Automotive Axles Limited | 2,229.17 | 17.05 | 109.95 | 18.97 | 579.63 |

| GNA Axles Limited | 1,506.26 | 17.32 | 23.28 | 12.47 | 186.69 |

| Talbros Automotive Components Limited | 778.27 | 19.03 | 17.82 | 20.47 | 87.02 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 24.55 |

| Non-Institutional Investor (NII/HNI) | 23.4 |

| Retail Individual Investor (RII) | 11.26 |

| Total | 17.66 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

KFin Technologies Limited

Phone: +91 40 6716 2222/ 18003094001

Email: einward.ris@kfintech.com

Website: www.kfintech.com

Company Promoters

- SUDHIR RAI

- ANITA RAI

- SUMEET RAI

- KUNAL RAI

Lead Managers

- Equirus Capital Private Limited

Company Address

Kross Limited

M-4, Phase VI, Gamharia, Adityapur Industrial Area, Jamshedpur - 832108, Jharkhand, India

Phone: +91 0657 2203812

Email: investors@krossindia.com

Website: www.krosslimited.com

FAQs

- What is the issue size of the Kross IPO?The Kross IPO has an issue size of ₹500 crore. This includes a fresh issue of ₹250 crore and an offer for sale (OFS) of ₹250 crore.

- What is the price band of the Kross IPO?The price band for the Kross IPO is ₹228 - ₹240 per share.

- What are the bidding dates for the Kross IPO?The Kross IPO will open for bidding on 09 Sep 2024 and close on 11 Sep 2024.

- What is the allotment date for the Kross IPO?The allotment date for the Kross IPO is 12 Sep 2024.

- What is the listing date for the Kross IPO?The listing date for the Kross IPO is 16 Sep 2024.

- What is the Kross IPO grey market premium?The grey market premium (GMP) for the Kross IPO is currently at ₹24.5, with an expected listing gain of approximately 10.21%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.