Excellent Wires and Packaging SME IPO Details, Financials, Valuation & Peers

Get everything you need to know about the Excellent Wires and Packaging IPO. Explore Excellent Wires and Packaging IPO details, including IPO dates, financial statements, valuation, peer comparison, and more.

Overview

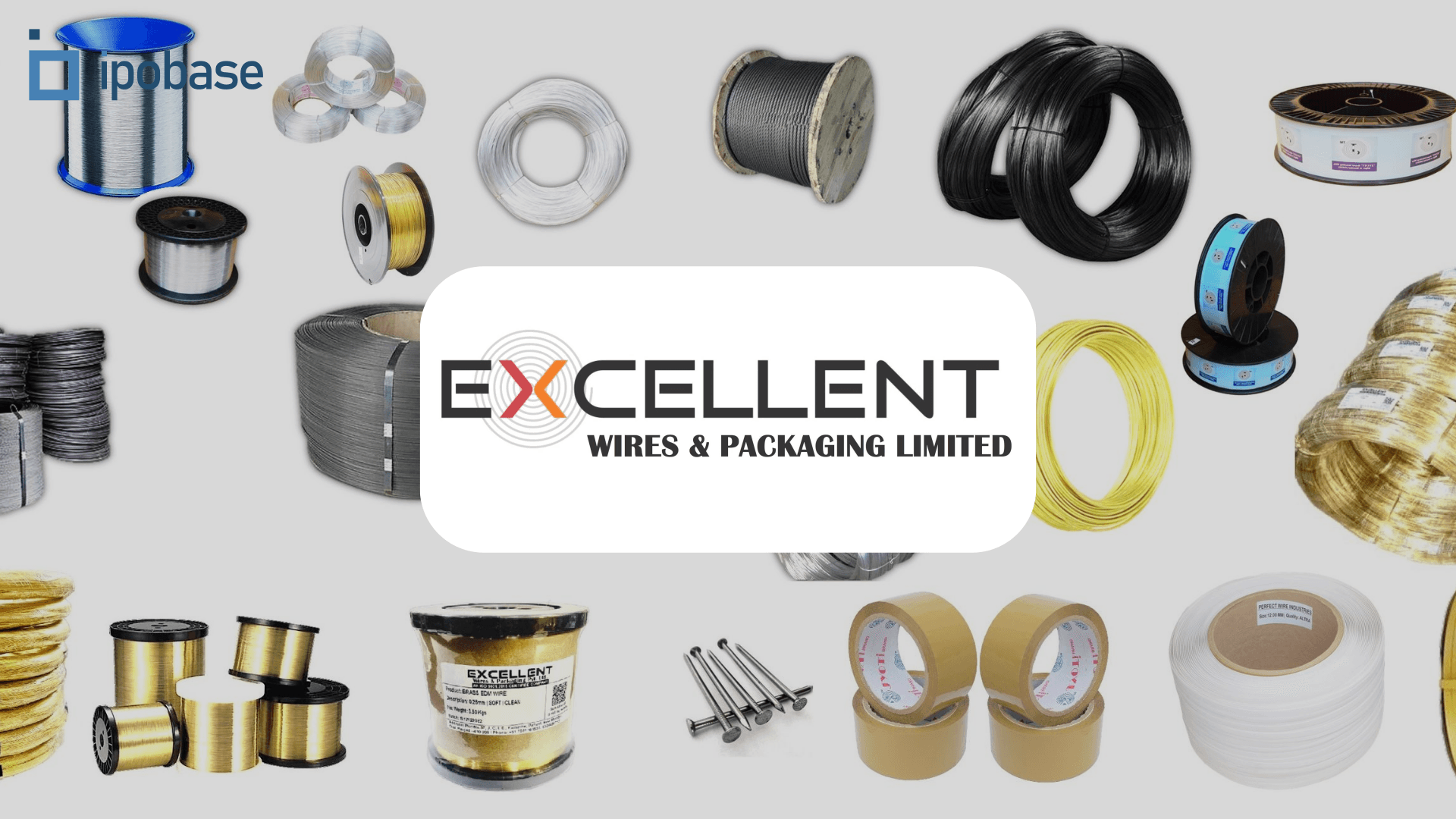

Excellent Wires and Packaging Limited, originally established as Perfect Wire Industries in April 2012, is a manufacturer of a diverse range of wire products. These include Spring Steel Wire, High Carbon Wire, Galvanized Wire (GI Wire), Round and Flat Stitching Wire, Mild Steel (M.S.) & Low Carbon Wire, Annealed Wire, Brass Wire, Copper Wire, Stainless Steel Wire, Spiral Wires, Binding Wires, Baling Wires, and a variety of Wire Ropes made of high carbon or stainless steel wire, with or without PVC coating. These products are marketed under the brand name Excellent. In addition, the company supplies packaging products such as PP Strapping Rolls and BOPP Self-Adhesive Tapes to its diverse clientele across industries such as packaging, engineering, stationery, imitation jewelry, wires & cables, and more.

Key Points:

- Product Range: Manufactures a wide array of wire products, including Spring Steel Wire, High Carbon Wire, Galvanized Wire, Brass Wire, Stainless Steel Wire, and Wire Ropes, catering to various industries under the brand name "Excellent."

- Packaging Products: In addition to wires, the company supplies packaging products like PP Strapping Rolls and BOPP Self-Adhesive Tapes, which are also sold under the "Excellent" brand.

- Quality Assurance: Committed to stringent quality control, the company conducts thorough in-house and external lab tests at every stage of production, ensuring that products meet specified standards.

- Strategic Expansion: Transitioned from a partnership firm to a corporate entity, absorbing all production facilities and assets. The company has streamlined operations by relocating and consolidating its manufacturing units, enhancing operational efficiency and reducing costs.

- Broad Clientele: Serves a diverse range of industries, including packaging, engineering, stationery, imitation jewelry, and wires & cables, with a strong reputation for quality and reliability.

Objects of the Issue

- Acquisition of Land and construction of Building

- Acquisition of Plant & Machineries

- Funding additional Working capital requirements

- General Corporate Purposes

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 11 Sep - 13 Sep 2024 |

| IPO Price Band | ₹90 per share |

| Fresh Issue | 14,00,000 shares |

| Offer For Sale | NIL |

| Total IPO Size | ₹12.60 crore |

| Face Value | ₹10 |

| Listing On | NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 11 Sep 2024 |

| IPO Closing Date | 13 Sep 2024 |

| Basis Of Allotment | 16 Sep 2024 |

| Refunds | 17 Sep 2024 |

| Demat Transfer | 17 Sep 2024 |

| IPO Listing Date | 19 Sep 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|

| Total Income | 7.29 | 14.48 | 15.41 |

| Total Expenses | 7.22 | 14.34 | 14.28 |

| Net Profit/Loss | 0.05 | 0.10 | 0.83 |

| NPM (*) | 0.65 | 0.72 | 5.39 |

| Total Assets | 2.43 | 3.25 | 7.05 |

| Total Liabilities | 2.36 | 3.08 | 3.08 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|

| EPS | 0.19 | 0.42 | 3.32 |

| ROE (%) | NA | NA | NA |

| ROCE (%) | NA | NA | NA |

| RoNW | 70.81 | 60.96 | 20.90 |

| D/E Ratio | NA | NA | NA |

| Current Ratio | 1.49 | 3.51 | 3.38 |

| EBITDA MARGIN (%) | 2.27 | 2.89 | 9.48 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Excellent Wires and Packaging | 15.41 | 27.11 | 3.32 | 20.90 | 15.90 |

| Bedmutha Ind | 868.14 | 36.59 | 6.28 | 16.34 | 37.38 |

| KEI Ind | 8,153.10 | 72.98 | 64.41 | 18.46 | 348.88 |

| Rajratan Global | 557.76 | 54.37 | 11.00 | 15.87 | 69.35 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 0 |

| Non-Institutional Investor (NII/HNI) | 8.75 |

| Retail Individual Investor (RII) | 32 |

| Total | 20.37 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

Bigshare Services Private Limited

Phone: +91 22-62638200

Email: ipo@bigshareonline.com

Website: www.bigshareonline.com

Company Promoters

- BHAVYA VASANT SHAH

- RACHIT PARESH MASALIA

- DARSHIL HASMUKH SHAH

Lead Managers

- Inventure Merchant Banker Services Private Limited

Company Address

Excellent Wires and Packaging Limited

Gala No. 1, Jyoti Industrial Estate, Vevoor Village, Ganesh Nagar, Palghar - E, Thane, Palghar - 401404, Maharashtra, India

Phone: +91 98202 85767

Email: info@excellentwiresandpackaging.com

Website: www.excellentwiresandpackaging.com

FAQs

- What is the issue size of the Excellent Wires and Packaging SME IPO?The Excellent Wires and Packaging SME IPO has an issue size of ₹12.60 crore. This includes a fresh issue of 14,00,000 shares and an offer for sale (OFS) of NIL.

- What is the price band of the Excellent Wires and Packaging IPO?The price band for the Excellent Wires and Packaging IPO is ₹90 per share.

- What are the bidding dates for the Excellent Wires and Packaging IPO?The Excellent Wires and Packaging IPO will open for bidding on 11 Sep 2024 and close on 13 Sep 2024.

- What is the allotment date for the Excellent Wires and Packaging IPO?The allotment date for the Excellent Wires and Packaging IPO is 16 Sep 2024.

- What is the listing date for the Excellent Wires and Packaging IPO?The listing date for the Excellent Wires and Packaging IPO is 19 Sep 2024.

- What is the Excellent Wires and Packaging IPO grey market premium?The grey market premium (GMP) for the Excellent Wires and Packaging IPO is currently at ₹0, with an expected listing gain of approximately 0%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.