Esprit Stones SME IPO Details, Financials, Valuation & Peers

Get everything you need to know about the Esprit Stones IPO. Explore Esprit Stones IPO details, including IPO dates, financial statements, valuation, peer comparison, and more.

Overview

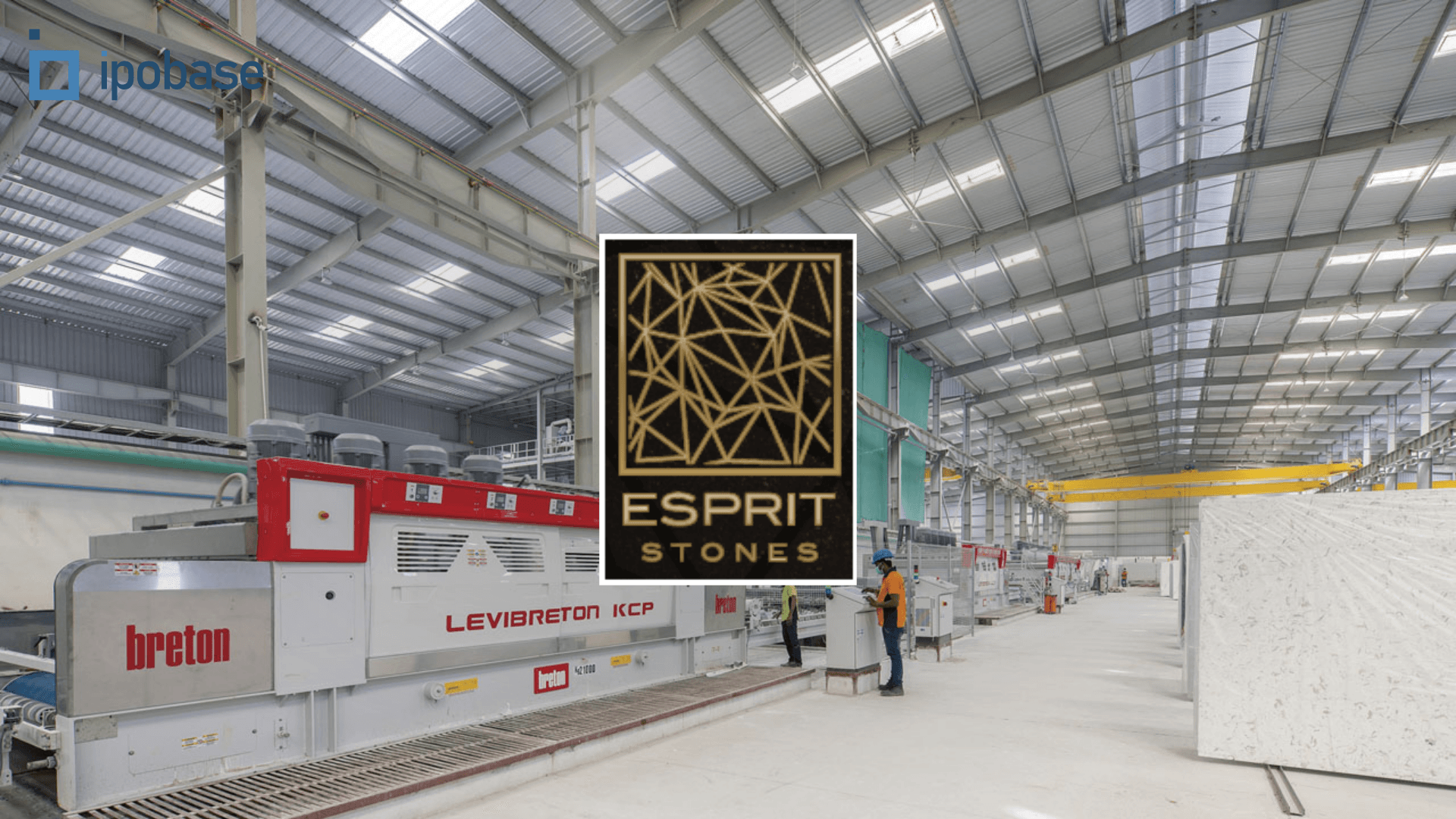

Esprit Stones Limited is a leading manufacturer of engineered stones in India, specializing in engineered quartz and engineered marble surfaces. Established in 2016 and promoted by two business houses from Udaipur, Rajasthan, the company has quickly expanded its manufacturing capacity and operations. With state-of-the-art facilities, Esprit Stones produces high-quality, durable, and aesthetically distinct engineered stones ideal for various residential and non-residential applications. The company caters to both domestic and international markets, exporting to over 10 countries and maintaining a strong presence in the USA.

Key Points:

- Diverse Product Range:

- Specializes in engineered quartz and engineered marble surfaces.

- Offers products in a variety of colors, styles, designs, and textures.

- Backward Integration:

- Produces unsaturated polyester resin, a key raw material, through its subsidiary Addwaya Chemicals.

- Ensures better control over raw material quality.

- Global Presence:

- Exports to over 10 countries, including the USA, Canada, Egypt, Bulgaria, UAE, and Saudi Arabia.

- Majority of sales come from exports, with significant exports to the USA.

- Domestic Expansion:

- Launched the premium brand Haique to meet growing domestic demand.

- Extended reach to 15 states in India through a network of distributors.

- Engages in online and print advertising, exhibitions, and events to promote the brand.

Objects of the Issue

- Funding Working Capital requirement of the Company

- Investment in the Subsidiary, Haique Stones Private Limited (HSPL), for repayment and / or prepayment in part or full of its outstanding borrowings

- Investment in the Subsidiary, Haique Stones Private Limited (HSPL) for funding its Working Capital Requirement

- General Corporate Purpose

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 26 Jul - 30 Jul 2024 |

| IPO Price Band | ₹ 82 - 87 per share |

| Fresh Issue | 57,95,200 shares |

| Offer For Sale | NIL |

| Total IPO Size | Approx ₹ 50.42 crore |

| Face Value | ₹ 10 |

| Listing On | NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 26 Jul 2024 |

| IPO Closing Date | 30 Jul 2024 |

| Basis Of Allotment | 31 Jul 2024 |

| Refunds | 01 Aug 2024 |

| Demat Transfer | 01 Aug 2024 |

| IPO Listing Date | 02 Aug 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| Total Income | 146.35 | 190.03 | 176.07 | 274.78 |

| Total Expenses | 124.45 | 166.35 | 170.75 | 260.68 |

| Net Profit/Loss | 15.47 | 18.51 | 3.56 | 10.32 |

| NPM (*) | 10.73 | 9.92 | 2.04 | 3.78 |

| Total Assets | 141.15 | 180.70 | 238.02 | 274.59 |

| Total Liabilities | 100.72 | 121.76 | 175.74 | 202.21 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| EPS | 9.58 | 11.46 | 2.13 | 6.29 |

| ROE (%) | NA | NA | NA | NA |

| ROCE (%) | 32.58 | 25.05 | 7.60 | 12.39 |

| RoNW (%) | 47.32 | 37.25 | 5.66 | 15.09 |

| D/E Ratio | 1.21 | 0.98 | 1.90 | 1.72 |

| Current Ratio | 1.78 | 1.59 | 2.47 | 2.03 |

| EBITDA MARGIN (%) | 20.85 | 17.79 | 10.89 | 12.17 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Esprit Stones Limited | 272.89 | 13.83 | 6.29 | 15.09 | 44.82 |

| Pokarna Limited | 687.61 | 25.33 | 28.18 | 15.89 | 191.05 |

| Pacific Industries Limited | 190.00 | 16.43 | 17.23 | 2.78 | 629.16 |

| Global Surfaces Limited | 225.29 | 51.34 | 4.41 | 6.68 | 77.98 |

| Elegant Marbles & Grani Industries Limited | 34.22 | 23.69 | 11.42 | 3.44 | 436.83 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 117.63 |

| Non-Institutional Investor (NII/HNI) | 399.58 |

| Retail Individual Investor (RII) | 145.75 |

| Total | 185.82 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

MUFG Intime India Private Limited (Formerly known as Link Intime India Private Limited)

Phone: + 91 810 811 4949

Email: ipo.helpdesk@linkintime.co.in

Website: https://linkintime.co.in/

Company Promoters

- SUNILKUMAR LUNAWATH

- NITIN GATTANI

- PRADEEPKUMAR LUNAWATH

- SANGEETA GATTANI

- ANUSHREE LUNAWATH

- SIDDHANTH LUNAWATH

Lead Managers

- Choice Capital Advisors Private Limited

- Srujan Alpha Capital Advisors LLP

Company Address

Esprit Stones Limited

SP1, Udyog Vihar, Sukher Industrial Area, Udaipur – 313 004, Rajasthan, India

Phone: +91 91166 52582

Email: legal@espritstones.com

Website: www.espritstones.com

FAQs

- What is the issue size of the Esprit Stones SME IPO?The Esprit Stones SME IPO has an issue size of Approx ₹ 50.42 crore. This includes a fresh issue of 57,95,200 shares and an offer for sale (OFS) of NIL.

- What is the price band of the Esprit Stones IPO?The price band for the Esprit Stones IPO is ₹ 82 - 87 per share.

- What are the bidding dates for the Esprit Stones IPO?The Esprit Stones IPO will open for bidding on 26 Jul 2024 and close on 30 Jul 2024.

- What is the allotment date for the Esprit Stones IPO?The allotment date for the Esprit Stones IPO is 31 Jul 2024.

- What is the listing date for the Esprit Stones IPO?The listing date for the Esprit Stones IPO is 02 Aug 2024.

- What is the Esprit Stones IPO grey market premium?The grey market premium (GMP) for the Esprit Stones IPO is currently at ₹33, with an expected listing gain of approximately 37.93%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.