Energy-Mission Machineries (India) SME IPO Details, Financials, Valuation & Peers

Get everything you need to know about the Energy-Mission Machineries (India) IPO. Explore Energy Mission Machineries (India) IPO details, including IPO dates, financial statements, valuation, peer comparison, and more.

Overview

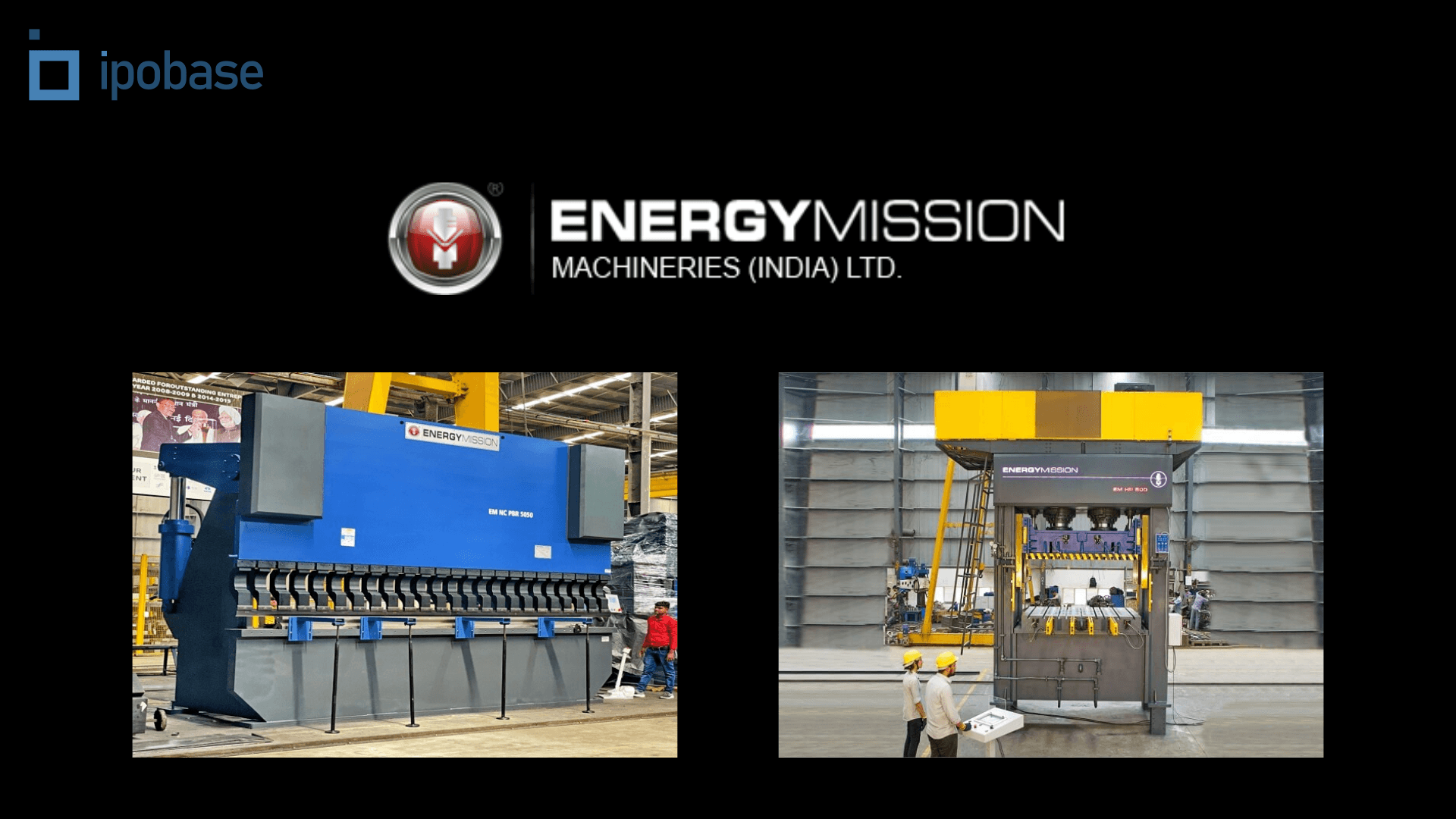

Energy-Mission Machineries (India) Limited, established in 2011, specializes in the design and manufacture of CNC, NC, and conventional metal forming machines. These machines cater to the metal fabrication needs of various industrial sectors, offering precision solutions for cutting and forming operations. The company’s diverse product range includes press brake machines, shearing machines, plate rolling machines, ironworkers, hydraulic presses, and busbar machines for bending, cutting, and punching.

Key Points:

- Product Range: The company offers over 600 variants of metal forming machines, serving industries such as automotive, steel, pre-engineered building, furniture, HVAC, agriculture, road construction, elevators, and food processing.

- Global Presence: Energy-Mission Machineries exports its products to countries including the USA, Switzerland, Russia, Nepal, Kenya, Uganda, UAE, Saudi Arabia, and other Middle Eastern countries, besides serving the domestic market in India.

- After-sales Support: Apart from manufacturing machines, the company provides machinery tools and spare parts to address after-sales support and services, ensuring customer satisfaction.

- Innovation: Energy-Mission Machineries stays ahead in innovation, recently launching four-roll machines at IMTEX 2024 and developing an automated material handling system for CNC machines.

Objects of the Issue

- Funding of capital expenditure towards civil construction work at existing manufacturing unit located at Sanand, District Ahmedabad, Gujarat

- Funding of capital expenditure towards installation of new plant & machineries

- To meet working capital requirements

- General Corporate Purpose

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 09 May - 13 May 2024 |

| IPO Price Band | ₹ 131 - 138 per share |

| Fresh Issue | Upto 29,82,000 Shares |

| Offer For Sale | NIL |

| Total IPO Size | Approx ₹ 41.15 crore |

| Face Value | ₹ 10 |

| Listing On | NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 09 May 2024 |

| IPO Closing Date | 13 May 2024 |

| Basis Of Allotment | 14 May 2024 |

| Refunds | 15 May 2024 |

| Demat Transfer | 15 May 2024 |

| IPO Listing Date | 16 May 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | Dec 2023 |

|---|---|---|---|---|

| Total Income | 48.34 | 79.07 | 100.66 | 84.0 |

| Total Expenses | 47.36 | 74.55 | 90.55 | 74.31 |

| Net Profit/Loss | 0.95 | 3.36 | 7.90 | 6.75 |

| NPM (*) | 2.0 | 4.29 | 7.93 | 8.10 |

| Total Assets | 65.76 | 73.82 | 82.59 | 99.58 |

| Total Liabilities | 53.49 | 58.19 | 59.05 | 69.30 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | Dec 2023 |

|---|---|---|---|---|

| EPS | 1.14 | 4.03 | 9.47 | 8.09 |

| ROE (%) | 7.89 | 24.10 | 40.35 | 25.08 |

| ROCE (%) | 10.12 | 17.15 | 28.08 | 21.86 |

| D/E Ratio | 1.82 | 1.57 | 0.93 | 0.77 |

| Current Ratio | 0.96 | 1.03 | 1.12 | 1.19 |

| EBITDA MARGIN (%) | 9.47 | 10.16 | 13.67 | 15.26 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Energy-Mission Machineries (India) Limited | 100.66 | 14.57 | 9.47 | 33.57 | 28.20 |

| Macpower CNC Machines Limited | 202.14 | 89.06 | 12.89 | 13.34 | 96.61 |

| Jyoti CNC Automation Limited | 952.60 | 779.56 | 1.02 | 18.35 | 5.57 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 161.92 |

| Non-Institutional Investor (NII/HNI) | 605.19 |

| Retail Individual Investor (RII) | 289.36 |

| Total | 320.67 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

Bigshare Services Private Limited

Phone: +91 22-62638200

Email: ipo@bigshareonline.com

Website: www.bigshareonline.com

Company Promoters

- Satishkumar Kanjibhai Parmar

- Dineshkumar Shankarlal Chaudhary

- Sanjay Shantukumar Khankar

- Ashokkumar Ramjibhai Panchal

- Snehal Narendra Mehta

- Sumitraben Mehta

Lead Managers

- HEM SECURITIES LIMITED

Company Address

Energy-Mission Machineries (India) Limited

E-9/3 & E-12 Sanand-II Industrial Area, Bol GIDC Sanand, Bol, Ahmedabad, Gujarat – 382 170, India

Phone: +91-7984768296

Email: cfo@energymission.com

Website: www.energymission.com

FAQs

- What is the issue size of the Energy Mission Machineries (India) SME IPO?The Energy Mission Machineries (India) SME IPO has an issue size of Approx ₹ 41.15 crore. This includes a fresh issue of Upto 29,82,000 Shares and an offer for sale (OFS) of NIL.

- What is the price band of the Energy Mission Machineries (India) IPO?The price band for the Energy Mission Machineries (India) IPO is ₹ 131 - 138 per share.

- What are the bidding dates for the Energy Mission Machineries (India) IPO?The Energy Mission Machineries (India) IPO will open for bidding on 09 May 2024 and close on 13 May 2024.

- What is the allotment date for the Energy Mission Machineries (India) IPO?The allotment date for the Energy Mission Machineries (India) IPO is 14 May 2024.

- What is the listing date for the Energy Mission Machineries (India) IPO?The listing date for the Energy Mission Machineries (India) IPO is 16 May 2024.

- What is the Energy Mission Machineries (India) IPO grey market premium?The grey market premium (GMP) for the Energy Mission Machineries (India) IPO is currently at ₹130, with an expected listing gain of approximately 94.2%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.