Divine Power Energy SME IPO Details, Financials, Valuation & Peers

Get everything you need to know about the Divine Power Energy IPO. Explore Divine Power Energy IPO details, including IPO dates, financial statements, valuation, peer comparison, and more.

Overview

Divine Power Energy Limited, originally incorporated as 'PDRV Enterprises Private Limited' on August 24, 2001, is a manufacturer specializing in Bare Copper/Aluminium Wire, Bare Copper/Aluminium Strip, Winding Copper/Aluminium Wire, and Winding Copper/Aluminium Strip. The company underwent several name changes before becoming 'Divine Power Energy Limited' in August 2023, transitioning from a private limited company to a public limited company. The company serves primarily power distribution companies and transformer manufacturers, playing a crucial role in the power transmission and distribution sector.

Key Points:

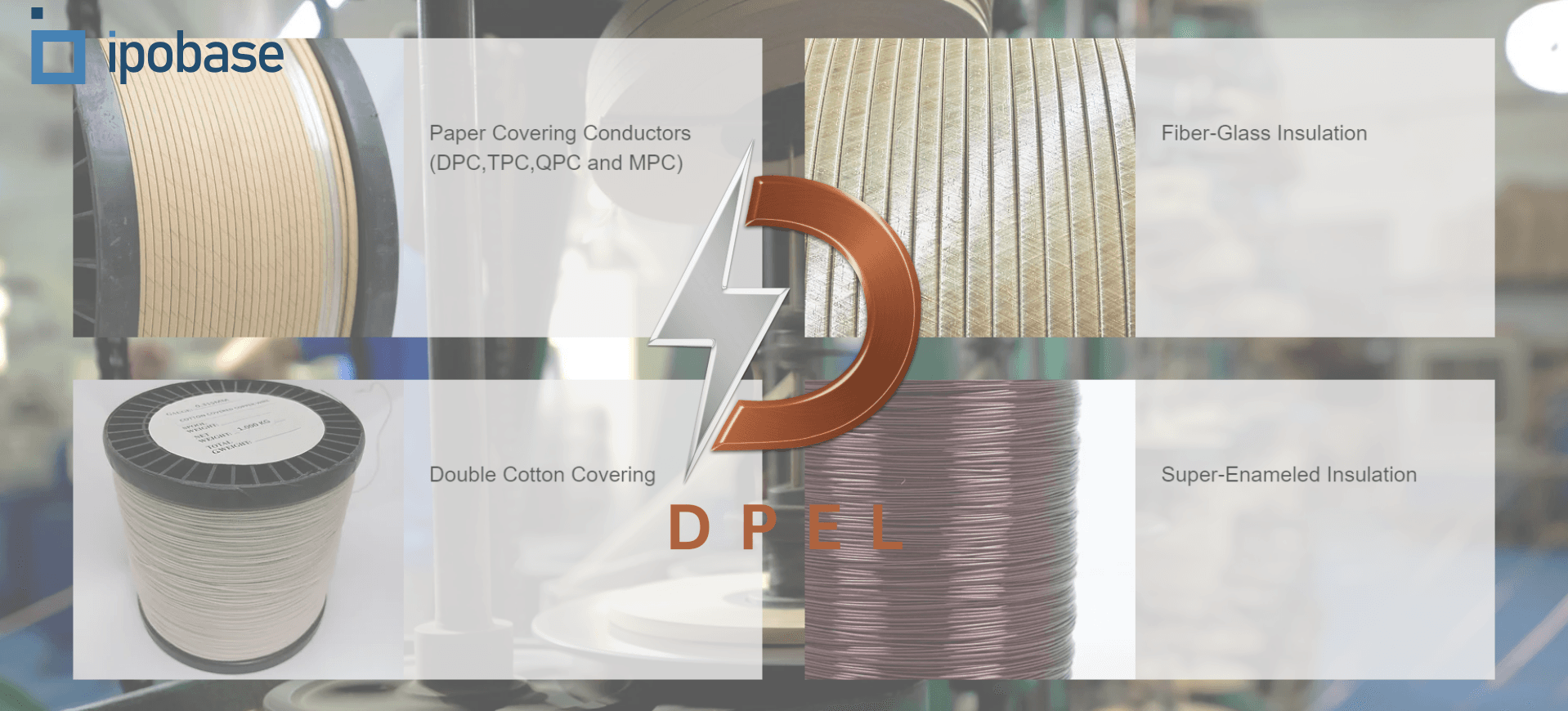

- Product Range:

- Bare Copper / Aluminium Wire

- Bare Copper / Aluminium Strip

- Winding Copper / Aluminium Wire

- Winding Copper / Aluminium Strip

- Insulation Materials: Paper, crepe paper, cotton, fiberglass, etc.

- Applications: Used in transformers and electromagnetic coils for lifting heavy objects.

- Manufacturing Capabilities:

- Location: Sahibabad, Ghaziabad.

- Facility Area: Total of 1,777 square meters, with a manufacturing area of 1,550 sq. m and an open area of 277 sq. m.

- Capacity:

- Aluminium: 300 metric tonnes per month.

- Copper: 400 metric tonnes per month.

- Machinery: Equipped with advanced machinery including Vertical Paper Covering Machine, Fiberglass Insulation Machine, and various Wire Drawing Machines.

- Market and Clients:

- Primary Customers: Power distribution companies and transformer manufacturers.

- Reputed Clients: TATA Power Limited, Pashchimanchal Vidyut Vitran Nigam Limited, BSES, and others.

- New Products: Manufacturing fiberglass-covered wires/strips for electromagnetic coils.

- Expansion and Growth:

- Government Initiatives: Benefiting from the Government of India's Revamped Distribution Sector Scheme aimed at reducing power losses and upgrading infrastructure.

- Market Demand: Increasing demand due to the need for reliable and efficient power distribution systems.

- Quality Assurance:

- In-House Quality Control: Equipped with a quality control lab and testing equipment to ensure product standards.

- Certifications: Adherence to industry standards for product quality, safety, and packaging.

Objects of the Issue

- To meet the working capital requirements of the Company

- General corporate purposes

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 25 Jun - 27 Jun 2024 |

| IPO Price Band | ₹ 36 - 40 per share |

| Fresh Issue | ₹ 22.76 crore |

| Offer For Sale | NIL |

| Total IPO Size | ₹ 22.76 crore |

| Face Value | ₹ 10 |

| Listing On | NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 25 Jun 2024 |

| IPO Closing Date | 27 Jun 2024 |

| Basis Of Allotment | 28 Jun 2024 |

| Refunds | 01 Jul 2024 |

| Demat Transfer | 01 Jul 2024 |

| IPO Listing Date | 02 Jul 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| Total Income | 116.60 | 122.90 | 150.84 | 222.72 |

| Total Expenses | 115.68 | 121.79 | 146.20 | 214.56 |

| Net Profit/Loss | 0.51 | 0.81 | 2.85 | 6.41 |

| NPM (*) | 0.44 | 0.66 | 1.89 | 2.88 |

| Total Assets | 61.56 | 62.76 | 72.53 | 88.89 |

| Total Liabilities | 49.91 | 50.30 | 53.37 | 63.33 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2021 | 31st March 2022 | 31st March 2023 | 31st March 2024 |

|---|---|---|---|---|

| EPS | 0.42 | 0.66 | 2.31 | 4.06 |

| ROE (%) | 4.35 | 6.46 | 14.87 | 25.06 |

| ROCE (%) | 2.83 | 8.80 | 13.70 | 16.25 |

| D/E Ratio | 3.83 | 3.58 | 2.49 | 2.26 |

| Current Ratio | 1.49 | 1.45 | 1.36 | 1.29 |

| EBITDA MARGIN (%) | 5.05 | 4.66 | 6.87 | 6.76 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Divine Power Energy Limited | 222.08 | 9.85 | 4.06 | 25.06 | 16.20 |

| Shera Energy Limited | 875.10 | 34.17 | 5.21 | 11.0 | 56.02 |

| Bhagyanagar India Limited | 1,430.72 | 7.63 | 14.29 | 23.65 | 60.44 |

| Rajnandini Metal Limited | 1,212.43 | 19.49 | 0.55 | 26.87 | 2.05 |

| Ram Ratna Wires Limited | 2,983.25 | 32.83 | 11.88 | 12.64 | 98.20 |

| Precision Wires India Limited | 3,301.69 | 33.60 | 4.08 | 14.39 | 28.35 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 135.84 |

| Non-Institutional Investor (NII/HNI) | 473.74 |

| Retail Individual Investor (RII) | 507.94 |

| Total | 393.67 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

Bigshare Services Private Limited

Phone: +91 22-62638200

Email: ipo@bigshareonline.com

Website: www.bigshareonline.com

Company Promoters

- MR. RAJESH GIRI

- MR. VIKAS TALWAR

- MS. DALI GIRI

Lead Managers

- KHAMBATTA SECURITIES LIMITED

Company Address

Divine Power Energy Limited

Unit No. Offices, 1st Floor, CSC-II, B-Block, Surajmal Vihar, New Delhi-110092, India.

Phone: 011-36001992/ 2842

Email: info@dpel.in

Website: www.dpel.in

FAQs

- What is the issue size of the Divine Power Energy SME IPO?The Divine Power Energy SME IPO has an issue size of ₹ 22.76 crore. This includes a fresh issue of ₹ 22.76 crore and an offer for sale (OFS) of NIL.

- What is the price band of the Divine Power Energy IPO?The price band for the Divine Power Energy IPO is ₹ 36 - 40 per share.

- What are the bidding dates for the Divine Power Energy IPO?The Divine Power Energy IPO will open for bidding on 25 Jun 2024 and close on 27 Jun 2024.

- What is the allotment date for the Divine Power Energy IPO?The allotment date for the Divine Power Energy IPO is 28 Jun 2024.

- What is the listing date for the Divine Power Energy IPO?The listing date for the Divine Power Energy IPO is 02 Jul 2024.

- What is the Divine Power Energy IPO grey market premium?The grey market premium (GMP) for the Divine Power Energy IPO is currently at ₹61, with an expected listing gain of approximately 152.5%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.