Abha Power and Steel SME IPO Details, Financials, Valuation & Peers

Explore Abha Power and Steel IPO details, including IPO dates, financial statements, valuation, peer comparison and more.

Overview

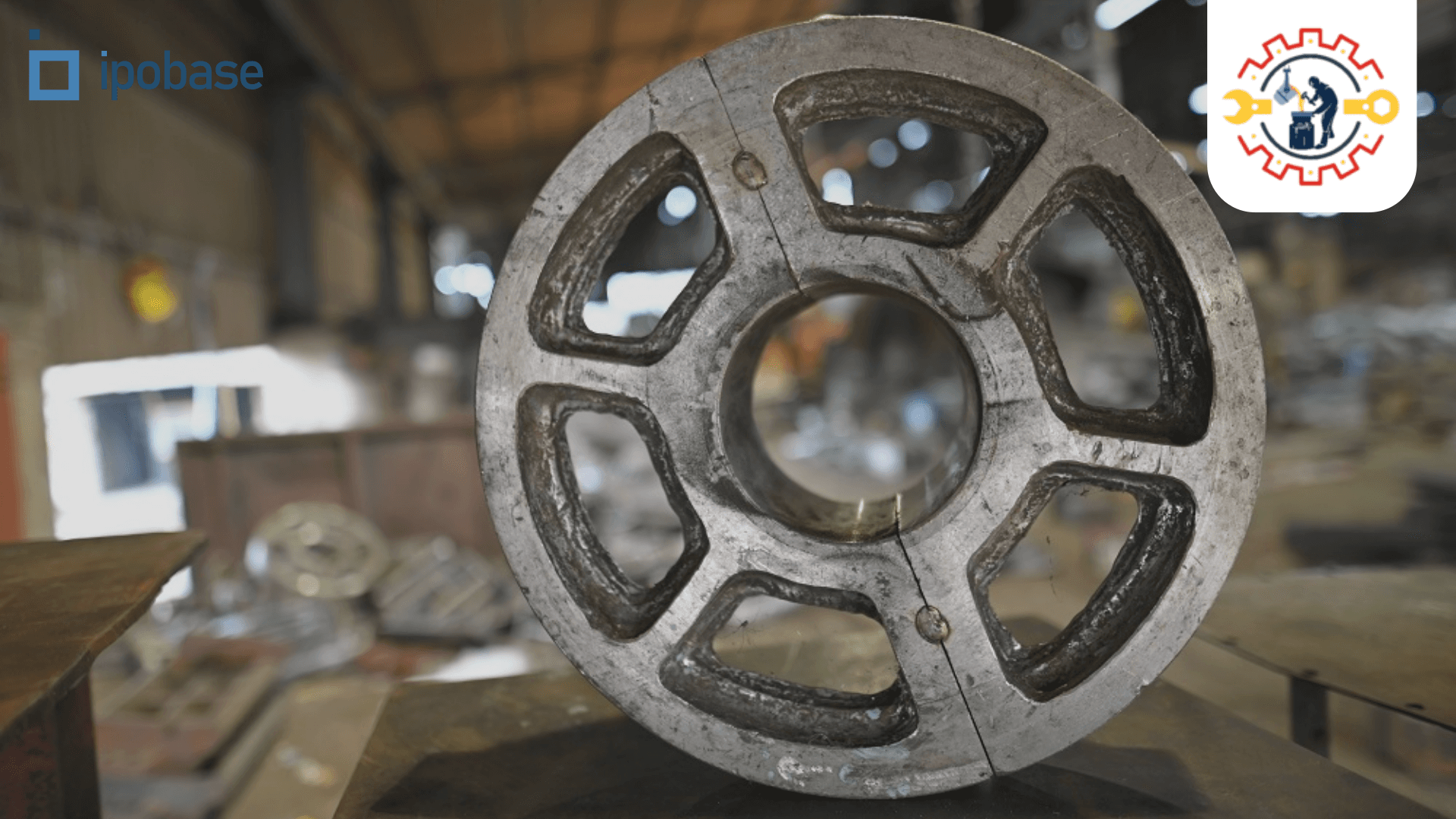

Abha Power and Steel Limited, headquartered in Bilaspur, Chhattisgarh, operates in the iron and steel foundry sector with a diverse portfolio of high-quality casting and manufacturing solutions. Strategically located in a mineral-rich and industrialized steel hub of India, the company caters to a wide range of industries, including Indian Railways, steel, cement, heavy engineering, mining, and power. The company specializes in producing customized products across various grades of iron and steel, including mild steel, spheroidal graphite cast iron, manganese steel, stainless steel, and high alloy castings, ranging from 0.5 kg to 6 tonnes per unit. With over 20 years of expertise, Abha Power and Steel is an RDSO-certified vendor for Indian Railways and an approved supplier for the National Mineral Development Corporation and other reputed organizations. The company exports to more than six countries, including Germany, UAE, and Canada, demonstrating its global reach. Equipped with modern manufacturing facilities spread over 319,200 square feet, the company integrates advanced technology, cost-efficient processes, and a captive solar power plant to ensure sustainable operations.

Key Points:

- Product Portfolio: Over 1,000 products, including customized solutions, catering to industries like Indian Railways, cement, power, and mining.

- Global Presence: Exports to six countries, including UAE, Germany, Canada, and Italy.

- Strategic Certifications:

- RDSO-certified for Indian Railways.

- PED Certification from TUV-Nord for pressure equipment exports to Europe.

- ISO 9001:2015 for quality management.

Modern Facilities:

- Manufacturing capacity: 14,400 MTPA as of March 2024.

- Equipped with melting, pouring, molding, heat treatment, and testing facilities.

- Sustainability Focus:

- Captive solar power plant with a 2.99 MW capacity, meeting ~35% of the company’s power needs.

- Expansion plans to increase self-sufficiency in energy.

- Long-Term Relationships: High customer retention with a significant proportion of revenue derived from repeat customers.

- Strong Market Position: Trusted supplier for Indian Railways, NMDC, and Integral Coach Factory, Chennai, among others.

Objects of the Issue

- Funding the capital expenditure towards modernization and upgradation of the manufacturing facilities in Bilaspur, Chhattisgarh to expand the product portfolio

- Funding working capital requirements of the Company

- General Corporate Purposes.

IPO Details

Discover essential information crucial for understanding an IPO, including the Price Band, Fresh Issue, Offer For Sale, Total IPO Size and more. Explore these key details to gain insight into the company's public offering.

| Fields | Details |

|---|---|

| IPO Dates | 27 Nov - 29 Nov 2024 |

| IPO Price Band | ₹75 per share |

| Fresh Issue | 41,39,200 shares (₹31.04 crore) |

| Offer For Sale | 10,00,000 shares (₹7.50 crore) |

| Total IPO Size | ₹38.54 crore |

| Face Value | ₹10 |

| Listing On | NSE |

IPO Timeline

Explore important dates like IPO opening, closing, listing and others, outlining the journey of the Public Offering. This will help you grasp the entire IPO journey effortlessly.

| Event | Date |

|---|---|

| IPO Opening Date | 27 Nov 2024 |

| IPO Closing Date | 29 Nov 2024 |

| Basis Of Allotment | 02 Dec 2024 |

| Refunds | 03 Dec 2024 |

| Demat Transfer | 03 Dec 2024 |

| IPO Listing Date | 04 Dec 2024 |

Financial Statements

Explore a comprehensive financial data table showcasing key metrics including revenue, expenses, net income, and others. Gain valuable insights about the company's financial performance at a glance, facilitating informed decision-making and strategic planning for subscribing to the IPO.

| Period Ended | 31st March 2022 | 31st March 2023 | 31st March 2024 | 15 Oct 2024 |

|---|---|---|---|---|

| Total Income | 54.98 | 55.12 | 51.83 | 37.55 |

| Total Expenses | 54.67 | 53.15 | 46.76 | 32.63 |

| Net Profit/Loss | -0.72 | 1.40 | 3.78 | 3.62 |

| NPM (*) | -1.31 | 2.56 | 7.31 | 9.73 |

| Total Assets | 35.37 | 44.77 | 47.36 | 51.36 |

| Total Liabilities | 24.17 | 31.01 | 29.82 | 30.20 |

* NPM represents the net profit margin, calculated as a percentage. All other figures are presented in crore (₹cr)

Valuation

Uncover significant valuation metrics such as EPS (Earnings Per Share), ROE (Return on Equity), ROCE (Return on Capital Employed), D/E Ratio (Debt-to-Equity Ratio), Current Ratio, and EBITDA Margin. These key indicators offer insights into the company's financial standing and performance, aiding in informed investment decisions.

| Period Ended | 31st March 2022 | 31st March 2023 | 31st March 2024 | 15 Oct 2024 |

|---|---|---|---|---|

| EPS | -0.50 | 0.97 | 2.62 | 2.51 |

| ROE (%) | -6.13 | 11.23 | 24.17 | 18.71 |

| ROCE (%) | 6.99 | 10.73 | 23.64 | 18.65 |

| D/E Ratio | 1.58 | 1.74 | 1.35 | 1.03 |

| Current Ratio | 2.01 | 1.59 | 1.83 | 1.96 |

| EBITDA MARGIN (%) | 3.01 | 6.10 | 15.73 | 16.95 |

* Compiled from DRHP/RHP for valuation purposes.

Peer Comparison

Compare key financial metrics with industry peers to gain valuable insights into the company's performance compared to its competitors.

| Name | Revenue | P/E | EPS | RoNW | NAV |

|---|---|---|---|---|---|

| Abha Power and Steel Limited | 51.75 | 28.63 | 2.62 | 24.17 | 12.14 |

| Bhagwati Autocast Limited | 134.00 | 20.40 | 24.10 | 18.40 | 142.00 |

| Nelcast Limited | 1,267.00 | 32.90 | 6.25 | 8.05 | 59.70 |

* Revenue in (₹cr), RoNW in (%), EPS, NAV in (₹). P/E ratio is based on the highest price from the IPO price band.

IPO Reservation

| Investor Type | Shares Offered |

|---|---|

| Non-Institutional Investor (NII/HNI) | Not less than 50% |

| Retail Individual Investor (RII) | Not less than 50% |

Subscription Data from NSE and BSE

| Investor Type | Subscribed |

|---|---|

| Qualified Institutional Buyer (QIB) | 0 |

| Non-Institutional Investor (NII/HNI) | 10.07 |

| Retail Individual Investor (RII) | 24.93 |

| Total | 18 |

* All figures represent multiples of the subscription. Check subscriptions for other ongoing issues here.

IPO Registrar

Skyline Financial Services Private Limited

Phone: 011-40450193-197

Email: ipo@skylinerta.com

Website: www.skylinerta.com

Company Promoters

- SUBHASH CHAND AGRAWAL

- ANKIT AGRAWAL

- ATISH AGRAWAL

- SATISH KUMAR SHAH

- LEELA DEVI AGRAWAL

- SUNFLOWER COMMOTRADE PRIVATE LIMITED

Lead Managers

- Horizon Management Private Limited

Company Address

Abha Power and Steel Limited

Silpahri Industrial State, Bilaspur, Chhattisgarh, India - 495001

Phone: +91 93022 21587

Email: cs@abhacast.com

Website: www.abhacast.com

FAQs

- What is the issue size of the Abha Power and Steel SME IPO?The Abha Power and Steel SME IPO has an issue size of ₹38.54 crore. This includes a fresh issue of 41,39,200 shares (₹31.04 crore) and an offer for sale (OFS) of 10,00,000 shares (₹7.50 crore).

- What is the price band of the Abha Power and Steel IPO?The price band for the Abha Power and Steel IPO is ₹75 per share.

- What are the bidding dates for the Abha Power and Steel IPO?The Abha Power and Steel IPO will open for bidding on 27 Nov 2024 and close on 29 Nov 2024.

- What is the allotment date for the Abha Power and Steel IPO?The allotment date for the Abha Power and Steel IPO is 02 Dec 2024.

- What is the minimum lot size and investment required for the Abha Power and Steel IPO?The minimum lot size for the Abha Power and Steel IPO is 1600 shares and the minimum investment required is ₹1,20,000.

- What is the listing date for the Abha Power and Steel IPO?The listing date for the Abha Power and Steel IPO is 04 Dec 2024.

- What is the Abha Power and Steel IPO grey market premium?The grey market premium (GMP) for the Abha Power and Steel IPO is currently at ₹15, with an expected listing gain of approximately 20%. Remember, the grey market premium is not an official indicator, but it reflects market perception and demand for the IPO shares.